what is fsa health care 2022

A flexible spending account FSA is an employer-sponsored benefit that helps you save money on many qualified healthcare expenses. If youre married your spouse can put up to 2850 in an FSA with their employer too.

Irs Releases 2022 Rates For Healthcare Fsa And Commuter Benefits Sequoia

An FSA is a type of savings account that provides tax.

. Employees can contribute up to 2850 to their LPFSAs in 2022 up 100 from 2021The HSA contribution limit for an individual is 3650 in 2022. According to the IRS the maximum amount an individual can contribute to the Healthcare FSA for 2022 is 2750. Seeing as there is no way to properly calculate the true cost of performing the trip by.

It can be used for over-the-counter medications allergy drugs first-aid supplies and digestive health. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your. The Dependent Care FSA.

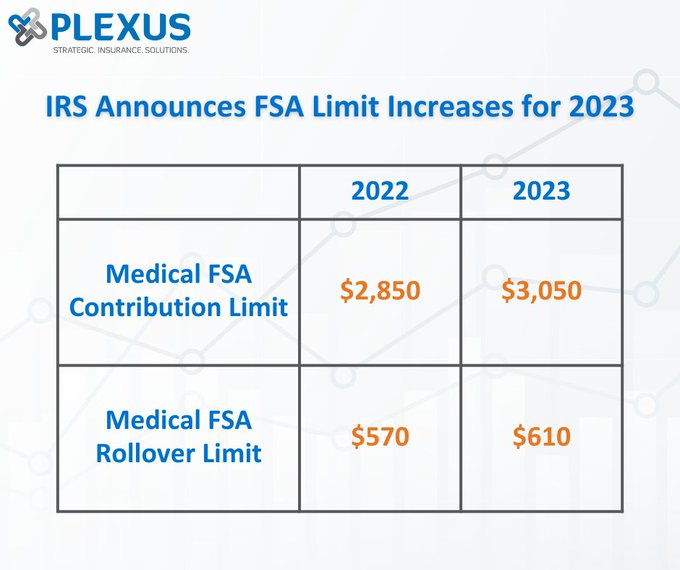

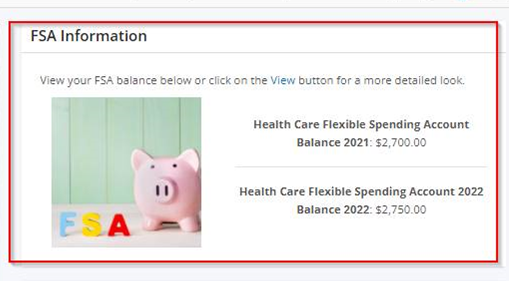

Health Cards Healthcare Hsa Fsa Or Hra Cards Visa Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored Healthcare Fsa Vs Hsa. You can contribute up to 2750 in 2021 and 2850 in 2022 into your Healthcare FSA. The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021.

This means youll save an amount equal to. Weekend 12 Midnight Fri-12 Midnight Sun. More Health Savings Account HSA Definition.

It allows you to contribute money tax-free and spend it on qualifying. Basic Healthcare FSA Rules Annual contribution limits. Employees in 2022 can put up to 2850 into their health care flexible spending accounts health FSAs pretax through payroll deduction the IRS has announced.

An FSA is an account that you can put money into to pay for certain out-of-pocket health care costs. You are eligible to. This would result in a.

You can use funds in your FSA to pay for certain medical and dental expenses for you your spouse if youre. Fsa carryover limit 2022 A flexible spending account is a tax-advantaged benefit that employers can offer. You can contribute pretax dollars to fund.

For 2022 participants may contribute up to an annual maximum of 2850 for a HCFSA or LEX HCFSA. A flexible spending account FSA is a type of savings account usually for healthcare expenses that sets aside funds for later use. LPFSA for dental and vision expenses.

FSAs only have one limit for individual and family health plan. FSA for health care expenses. Employees in 2022 can put up to 2850 into their health care flexible spending accounts health FSAs pretax through payroll deduction the IRS has announced.

Its a tax-deductible savings account that you can use for a variety of expenses. This is an increase of 100 from the 2021 contribution limits. Columbus Day Dates.

Learn about FSAs flexible spending accounts how FSAs work what they are and how they may help you cover out-of-pocket medical expenses. You dont pay taxes on this money. In 2023 these amounts will rise to 3850 for self-only coverage or 7750 for family.

For 2022 you can contribute 3650 for self-only coverage or 7300 for family coverage. Health Care FSA Contribution Limits Change for 2022 Health 7 days ago For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or. A flexible spending account FSA is offered through many employer benefit plans and allows you to set aside pretax money for eligible health care-related out-of-pocket.

A healthcare flexible spending account FSA is an employer-owned employee-funded savings account that employees can use to pay for eligible healthcare expenses. The Savings Power of This FSA.

What Is The Fsa Carrover Limit For 2022 Smartasset

Flexible Spending Account Fsa Basics Faqs Updated For 2022

Hra Vs Fsa See The Benefits Of Each Wex Inc

What Is The Fsa Carrover Limit For 2022 Smartasset

Irs Releases 2022 Health Savings Account Hsa Contribution Limits

New 2022 Brochure For Dependent Care Assistance Plan Fsa Benefit Plan Document Core Documents

Fsa Hsa Contribution Limits For 2022 Stratus Hr

Health Care And Limited Use Fsa Human Resources Northwestern University

2022 Health Fsa Contribution Limitations And Benefits For Your Flexible Spening Accounts Marca

Healthcare Spending Accounts Fsa Vs Hsa Prestige

Navia Benefits Health Care Fsa

The Power Of A Health Care Flexible Spending Account Flex Made Easy

What Is A Dependent Care Fsa Wex Inc

Hsa Vs Fsa Comparison Chart Aeroflow Healthcare

Irs Allows Midyear Enrollment And Election Changes For Health Plans And Fsas